In all the years of helping business owners and networking at mastermind groups I’ve notice a few constants. One of them is being able to talk about your business in terms of numbers. Like what does it cost to generate a new customer and what’s the profit from that customer. This sounds basic but it’s one of the filters that Shark Tank uses to keep people OFF the show! Don’t blow your opportunity, learn these 5 Key Business Metrics Every Business Should Know.

1. Customer Acquisition Cost (CAC) AKA CPA Cost Per Acquisition

The CAC answers, “How Much Money Does It Cost To Generate 1 Customer?” For many business owners, they will do this calculations by simply taking their marketing spending in a particular source and divide that by the number of clients they get form that. If they spend $1,000 and get 10 new clients, they assume $100 CPA. While that’s a decent ballpark number, you should consider taking it one step further and figure out how much time or salary gets used during this conversion process. Not all lead sources are the same and adding this dimension helps make the number more accurate. Let’s look at an example.

Scenario 1: Business spends $1,000 on 100 leads that turn into 10 clients. So most businesses, think this is great, $100 per client! However, if it costs $10,000 man hours to convert that client, then you have $1,100 customer acquisition cost. Still good.

Scenario 2: Consider networking. I love networking and think it’s very valuable and worth your time. Some business owners would get clients through networking don’t track it at all or it has this massive ROI number on it. The best businesses add lunches, etc to this category to get a better number, let’s say you spend $1,000 on lunches, golf outing and networking meetings to generate 10 clients. You have the same initial cost as scneario 1. However, it takes you $20,000 man hours of follow up and attend these meetings to conver them. Now you have a $2,100 CAC.

The key is to get this number down because it helps you in other areas.

2. Lifetime Value of Customer (LTV)

No that’s not Loan To Value, this is Lifetime Value of a Customer. There are many ways to figure this out, but you can take the average revenue from a period say 1 month or 1 year and simplymultiply it by the number of years they will continue to use your business.

(Average Value of a Sale) X (Number of Repeat Transactions) X (Average Retention Time in Months or Years for a Typical Customer)

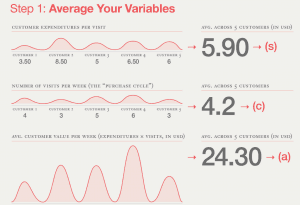

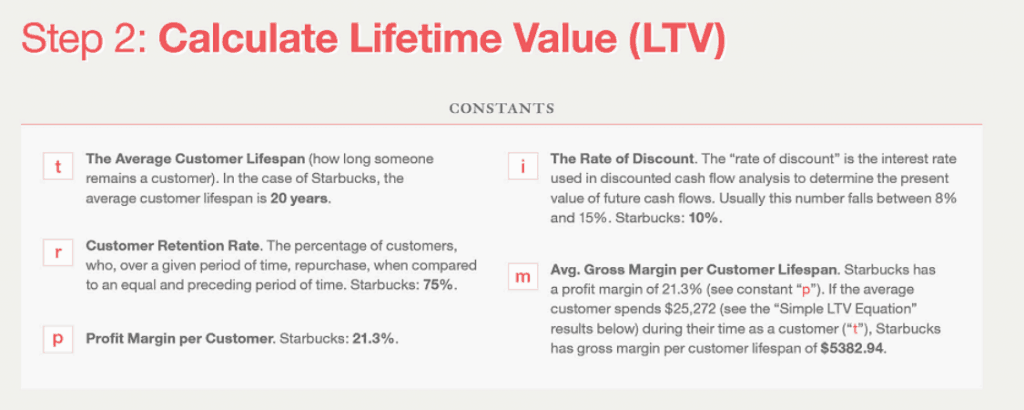

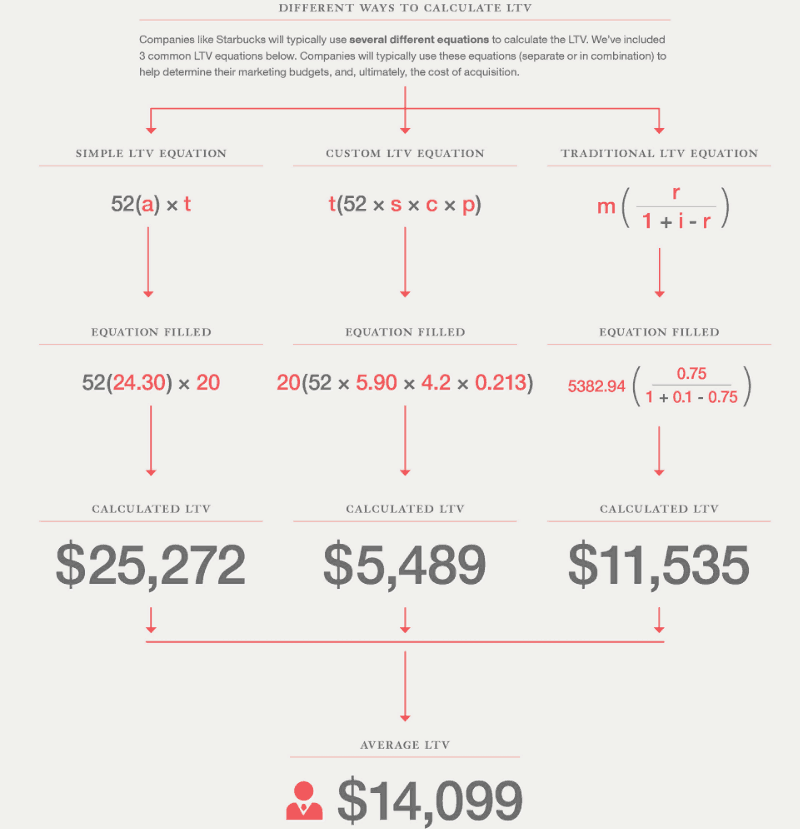

Reportedly, Starbucks says each customer is worth $14,099. The images show you how they got there.

Realtor Example: The average home costs $200,000, the average commission on that is $6,000, the average person moves every 10 years and since I will stay in touch with them, they will likely buy at least 3 homes from me, making the LTV for the average customer $18,000… actually that’s incorrect, because they will sell their home and buy, so that’s an addition 2 sales, bringing it to $30,000. Of course that’s incorrect as well, because while most 1st time home buyers buy around the median or average price, people who sale and buy move up to secondary home markets and downsizing/retirement-empty-nester communities. I’ll let you do that math but it could come to say $50,000.

For those of you in the SAAS (Software As A Service) industry you can see why this number is important. You could easily spend $1,000 CAC when you calculate the time it took to build your app. IF the monthly spend is $100/mo that’s a losing proposition. However, if the LTV is $50,000, then you could spend even more acquiring customers.

Lifetime Value of a Customer answers the question, “Why is customer service after the sale important?” and “How much should I spend on keeping this client?”

Bonus: CAC/LTV Ratio

Simply put you take CAC and divide it by the LTV. IF you get a number of 3+ you’re doing awesome. If it’s lower than that, you have work to do.

Website Traffic

Web Traffic is often hard to decipher but to round out our 5 key metrics we have 3 key metrics for you to master.

3. Users

If you can only choose 1 pick users. There are other metrics such as sessions. However, users represent actual customers (or potential customers). Sessions represent visits to the site. Think about a fast food place. A user starts their session at the drive through and it ends when they receive their food. If they forget something and get in line again, they’d count for 2 sessions but only 1 user.

4. Conversion Rate

In order to have a conversion rate you have to set goals up in Analytics, but you should know how many users it takes to convert into a sale. IF you don’t know this then you’ll never know if all traffic generation tactics are succeeding. Once you know your conversion rate online then you’ll have an idea of how to calculate your online lead conversion.

5. Source Of Business

Whether this is offline or online, knowing the source is key to understanding your business. In this case, you can figure out where your users come from and what percentage of them turn into leads through what channel. Is Facebook really better for your business, you can drill down here and figure out which growth hack is working.